2025 Women & Girls Study: What local employers can do to boost women’s economic security

The 2025 Women & Girls Study in Allen County reveals a decline in economic security for women and offers immediate solutions for Allen County employers.

Five years after the first modern Women & Girls Study in Allen County, a new 2025 update from the Women’s Fund of Greater Fort Wayne shows troubling declines in women’s economic security. Yet alongside these data points are solutions that employers and community leaders can act on immediately.

The report, produced in partnership with the Community Research Institute (CRI) at Purdue Fort Wayne, focuses on three areas: economic security, personal safety, and the experiences of young women and girls. Economic security emerged as the most robust portion of the research, offering insight into wages, flexibility, and retirement savings among women ages 18-64.

A widening wage gap that affects the whole community

CRI analyzed 15 years of local earnings data and found that the wage gap between men and women in Allen County hasn’t narrowed.

“Over that 10 years, that wage gap actually grew,” says Rachel Blakeman, Director of CRI. The gap exists nationwide, she notes, but the growth in Allen County carries broad economic consequences. When women earn less, less money circulates through the local economy.

“The disparities are real, and they continue to exist,” Blakeman says.

The report also shows that while fewer women earn below $25,000 than in 2009, these gains are eroded by inflation and rising costs of living. Although more women now earn above $75,000, these increases still lag behind state and national growth.

For single mothers, the challenge is especially stark. Married couples with children in Allen County have a median income of roughly $107,000. For single mothers, it is $35,000.

“Women are the economic engines of families,” says Cassie Beer, Executive Director of the Women’s Fund. “If we have more income in the pockets of women, it’s going to boost our entire local economy.”

The flexibility gap

Survey results point to a clear mismatch between what women need from employers and what many workplaces currently provide.

More than one in three women report having no flexibility in their start or stop times — a constraint that affects parents with school-age children, employees caring for elders, and anyone who needs basic scheduling autonomy.

Beer sees opportunity here. While some roles, like educators or clinicians, require fixed hours, she says many jobs can adopt “structural creativity.” That could include job sharing, predictable scheduling, expanded paid time off, or shorter probationary periods before employees can access benefits like paid time off.

According to the survey, 51% of women are considering a job change in the next one to two years, with pay and flexibility topping the list of motivators.

“If at any given time, half of the women in your workforce are keeping an eye out for another position, that’s telling you something,” Beer says.

Retirement savings: A solvable math problem

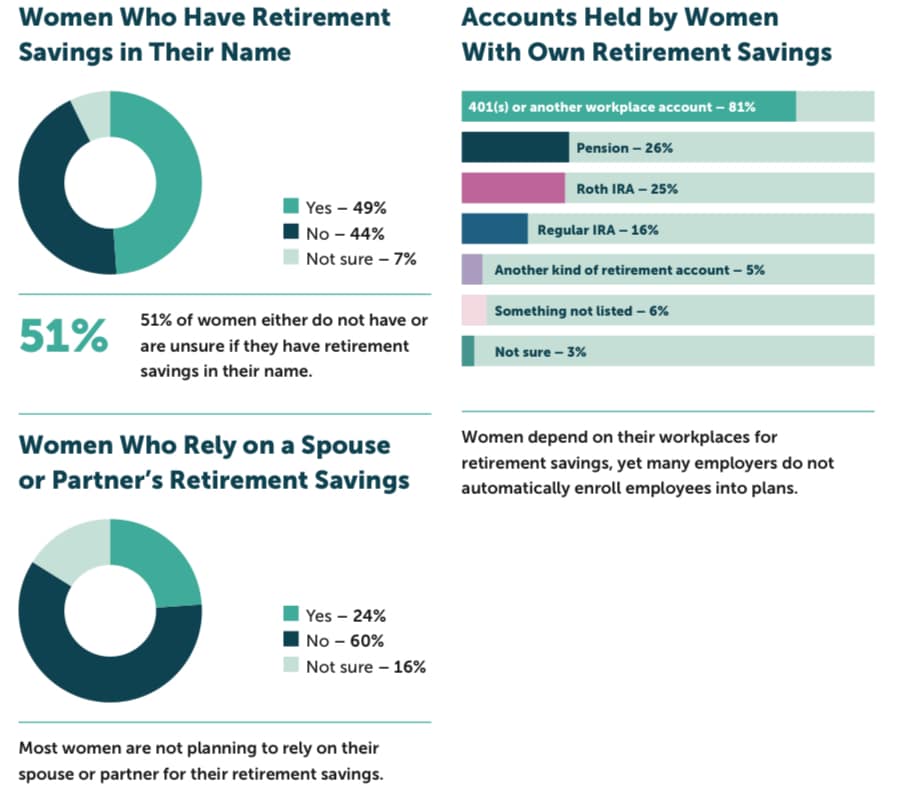

One of the report’s most striking insights: less than half of working-age women in Allen County have retirement savings in their own name. Most women who aren’t saving cite the same reason — they simply cannot afford to.

Beer stresses that this contradicts persistent stereotypes about financial literacy.

“It’s not that they’re too confused or too intimidated,” she says. “They can’t afford to.”

Data show that employer-sponsored plans, especially 401(k)s, are the most reliable tool for long-term financial security. Expanding access to retirement benefits and raising wages so women can contribute are two of the clearest, most immediate steps employers can take.

Education barriers and the workforce cycle

Education is another area where targeted interventions could make an outsized impact. The report finds many women begin a college degree but do not finish. Beer notes that one in three undergraduate women are mothers, and without childcare, flexible work schedules, or wages that meet basic needs, completing a degree becomes unrealistic.

Blakeman describes this as a regional cycle: a workforce with fewer credentials makes it harder to attract high-wage employers, and the absence of high-wage jobs discourages residents from pursuing more education.

Breaking this cycle, she says, requires coordinated support from both employers and educational institutions.

Solutions start with data

The Women’s Fund is asking employers to use these findings to evaluate their own practices, starting with the simplest and most impactful next step: participating in the Compass Survey

The survey is open through December 12 and is designed for medium- to large-sized employers with decision-making authority in Allen County. It is confidential, free, and deliberately practical.

All participating employers receive an individualized scorecard with personalized recommendations for building more inclusive workplaces and improving retention. Those who meet or exceed benchmarks will be recognized at the 2026 Women in the Workplace Luncheon.

Beer says the Compass Survey is one of the strongest tools the region has for turning research into action. “We’re not just publishing data,” she says. “We’re giving employers a pathway for next steps.”

Where the Women & Girls Study identifies challenges, the Compass Survey offers a blueprint for solutions.

A forward path

Asked what single change she would make to improve women’s economic security in Allen County, Beer’s answer is direct.

“I would pay them more.”

But she also sees momentum. She points to local organizations across sectors already advancing supportive policies:

- Accounting firm Katz Sapper Miller (KSM) has expanded support for parents returning from leave.

- Indiana Tech now offers benefits for employees caring for young children, aging adults, or family members with disabilities.

- Stillwater Hospice has implemented comprehensive changes, including a pay-equity audit.

More leaders, she says, are realizing that improving conditions for women strengthens the entire workforce.

Call to Action

Allen County employers can participate in this year’s Compass Survey until December 12.

Participation is confidential and free, and every employer receives a personalized scorecard with actionable next steps for retention and inclusion.