How are Fort Wayne organizations helping people keep their utilities on this winter and cut costs?

"We've definitely had an increase (in interest in our energy assistance programs). But we've also increased the types of programs we have available."

This story is part of Input Fort Wayne’s Solutions Series, made possible by support from the United Way of Allen County, the NiSource Foundation, NIPSCO, Brightpoint, and others in Northeast Indiana. The 10-part, 10-month series explores how our regional community is addressing residents’ essential needs during the pandemic. Read the first story here.

***

When it comes to covering basic needs, utilities might not be top of mind for many people who haven’t experienced poverty firsthand. However, according to government data, keeping the lights on and the home warm can come at a steep cost, particularly for renters during a pandemic.

According to the 2019 American Housing Survey (AHS) released in September 2020 by the U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau, the percentage of American renter households spending 30 percent or more of their income on housing costs held steady at 51 percent between 2017 and 2019.

Though federal data is not yet available that indicates the impact the pandemic has on utility bills, Fort Wayne leaders working at social service organizations see anecdotal evidence that a lack of access to income during the pandemic and ongoing challenges finding well-paid employment have resulted in many residents feeling financially “pinched,” as Rena Bradley, Community Development Director with Bridge of Grace Compassionate Ministries Center, puts it.

Bridge of Grace is located in South East Fort Wayne’s 46806 zip code, which has been identified as one of the two lowest income zip codes in the state of Indiana. During the pandemic, Bridge of Grace offered a temporary food distribution center to its neighborhood at 5100 Gaywood Dr. in the summer of 2020 and surveyed residents who stopped by about their most urgent challenges.

According to Bradley, residents indicated their challenges included expenses associated with paying for utilities, rent, food, and gas (car fuel)—in that order. Future challenges that community residents anticipated facing in the next two to three months included utilities, food, and rent expenses, access to personal protective equipment, and phone bill expenses (in that order).

When asked about potential solutions, Bradley says most residents offered ideas, like payment assistance (for utilities, childcare, and rent), internet access, and financial coaching.

Fast-forward to current times, and two leaders from the social service agency Brightpoint offer anecdotal evidence that the pandemic-fueled situation is likely about the same or even worse, on the balance.

“We’ve definitely had an increase (in interest in our energy assistance programs),” says Family Support Services Manager, Lesa Cassel. “But we’ve also increased the types of programs we have available. There have been multiple funding sources that have stepped up and provided funds to help with utilities, rent, mortgages, and the like. You name it, and we’ve had funding for it—namely, the utility assistance program.”

Pushed over the edge

Cassel’s colleague Pam Brookshire—who serves as vice president of community services—says the federal American Rescue Plan Act was a boon to their agency and the clients who benefit from their programs. For instance, if a client comes in with a $2,000 electric bill, and they can’t seem to make any headway on it, they can use certain funding to help them get back to a zero balance.

“I don’t want to say we’re serving more people,” Brookshire says. “But I would say we’re serving people better.”

It would be accurate to say Brightpoint is reaching different demographics of people in Fort Wayne’s community, too. In addition to their usual elderly and disabled clients, they’re now also serving more Asset Limited, Income Constrained, Employed (ALICE) families—people who were pushed over the financial edge by the pandemic.

“We’ve had a lot of new clients—people whom we’ve not seen ever before,” Brookshire says. “These are people who qualified for the programs now, but they might not have in the past.”

While each situation is different, Brookshire says the households tend to represent two-parent families. Maybe one parent is working, but the other quit or has had their hours cut back due to supply chain issues or COVID-related shutdowns.

Changing lifestyles

Along with the aforementioned challenges making family budgets tight, there’s another wildcard trend Brookshire believes might be contributing: Changing lifestyles and a lack of affordable childcare or consistent, in-person schooling for children during the pandemic.

“I also think that (some) families found during the pandemic, that if they can make it work with one income, they’re going to do that,” she says. “Because somebody needs to stay home and nurture the family, and it’s not worth the stress of trying to get everybody out of the house. So I think lifestyles are changing for a lot of families as well.”

This means that many of the families in this situation are bringing in less money than they did pre-pandemic. One high electric bill could add strain on an already precarious situation. At the same time, federal income guidelines for many assistance programs have loosened, allowing Brightpoint to support more families in these situations, who have previously fallen through the gaps of social services.

“Based on our Community Services Block Grant (CSBG) report, about 65 percent of the households we serve still fall at 125 percent of the federal poverty level and below,” says Brookshire. “But, at least, we can finally start addressing some of the concerns of those families that are just that little at a bit above the Federal Poverty Level.”

For context, a family of four would need to make $33,125, or less, annually to qualify for certain programs. Also, on the subject of money, Brookshire says the deposits required by electric companies can keep many households in a cycle of poverty. If a customer falls behind on a bill three months in a row, the utility company will impose a deposit going forward. This puts a strain on people already living on the edge.

“They’ll split the deposit up over three months, but that’s additional funds that you’re not able to use (on living expenses),” says Brookshire. “And then, if you’re late again three more months, they do another one and another one. It’s been pretty tough on a lot of our families in this position.”

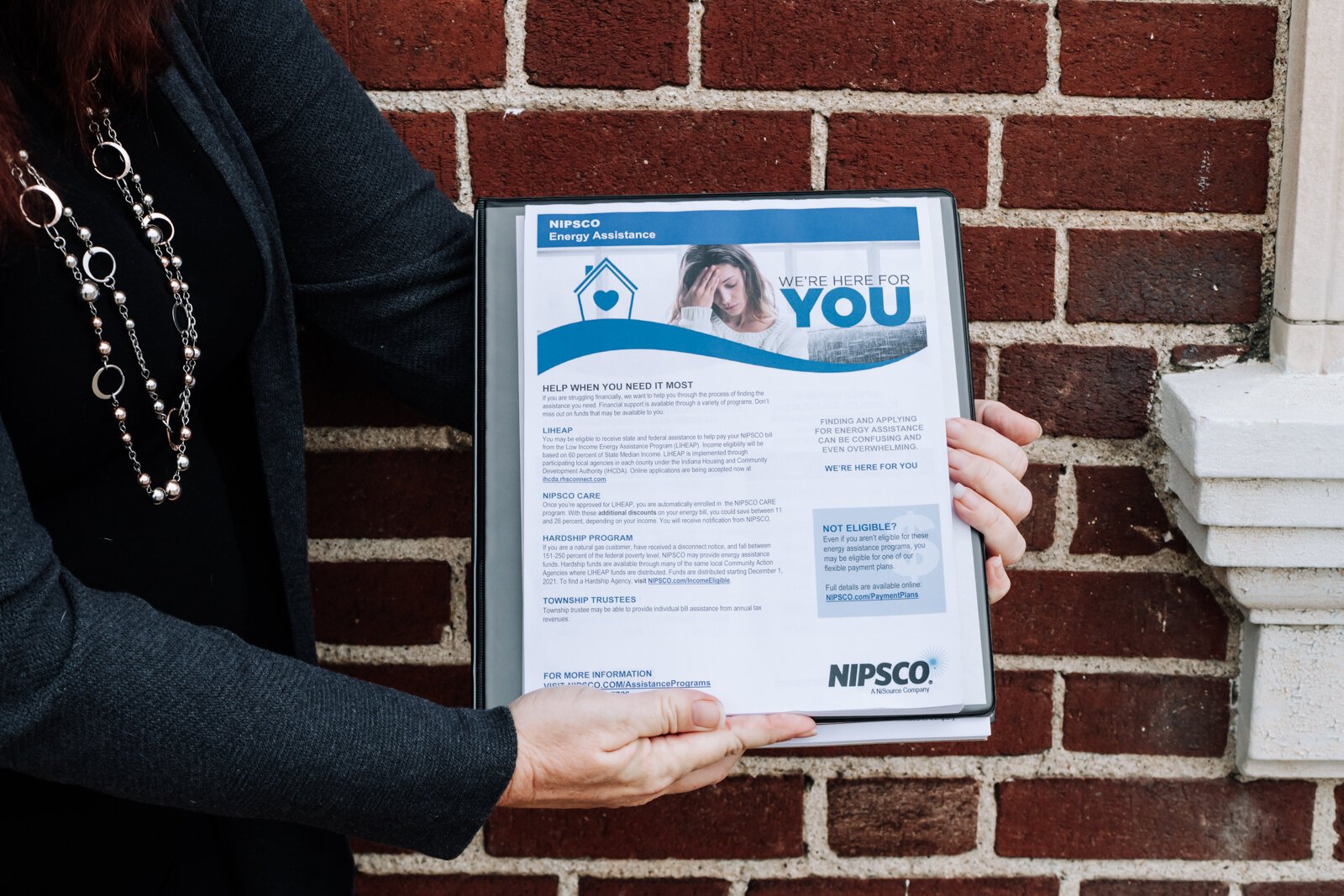

NIPSCO is the largest natural gas distribution company and the second-largest electric distribution company in Indiana, serving more than 821,000 natural gas customers and 468,000 electric customers across the Northern third of the state, including Northeast Indiana.

As Public Affairs and Economic Development Manager with NIPSCO, Dana Berkes says they acknowledge that certain households are burdened by high energy bills and need help.

“Once you’re accepted into the federal Low-Income Energy Assistance Program (LIHEAP), you’re automatically enrolled in what’s called NIPSCO Care,” she says. “It’s based on income eligibility, and you can save between 11 and 26 percent off of the energy bill.”

Berkes says they also have safeguards in place for consumers who may find themselves in dire financial straits due to unforeseen emergencies or expenses. The Hardship Program is designed to help address these shortfalls.

“If customers have received a disconnect notice and their income falls between 151 and 250 percent of the federal poverty level, there are funds that are available as a separate pot of money that Community Action Agencies have available when folks come in with a disconnect notice,” she says.

Energy-saving solutions

Brightpoint is among those Community Action Agencies on the front lines, but their work goes beyond employing a reactive approach to energy challenges. Poorly insulated rental or owner-occupied homes only make the utility situation worse, particularly in Indiana’s harsh, colder months.

Brookshire says she’s seen $600 or $700 monthly electric bills among Brightpoint’s clients. In some cases, Brightpoint can help address the root cause of these astronomically high bills. For example, the organization’s Weatherization program offers a home energy audit, energy-efficient repairs, and education to both renters and homeowners.

Though funding for this program is limited, the impact is meaningful. It has enough resources to weatherize 85 to 90 homes a year in Allen, DeKalb, LaGrange, Miami, Noble, Steuben, Wabash, and Whitley counties. Families must meet Energy Assistance Program income guidelines. Applications are scored on the highest energy burden and based on federal and state priority systems. All applications are placed on a waiting list based on the scores.

Brightpoint also offers hope in the form of an emergency repair and replacement program for families who have a broken HVAC system. According to Brookshire, they help about 50 families a year through that program.

“If their furnace isn’t working, they can complete the interview systems application, and we can get a contractor out there and hopefully get there to do a repair or a total replacement,” she says. “And typically, we’ll do a pretty quick turnaround for that.”’